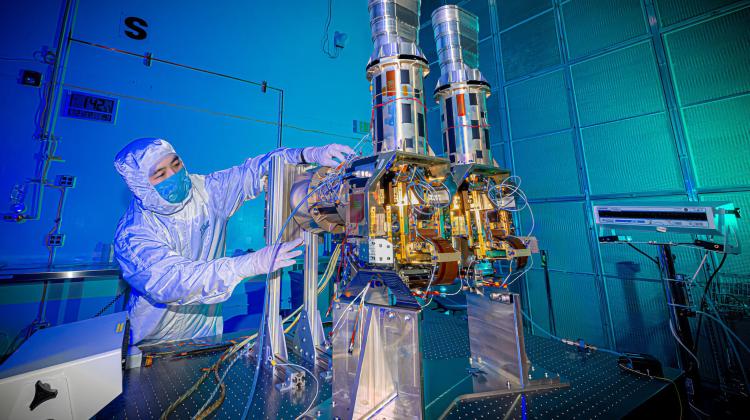

A pair of groundbreaking spectrometers developed by EDF for MethaneSAT, the most advanced methane-tracking satellite during its operation, are prepared for testing. Photo credit: Blue Canyon Technologies

Advancing toward a clean energy future

A pair of groundbreaking spectrometers developed by EDF for MethaneSAT, the most advanced methane-tracking satellite during its operation, are prepared for testing. Photo credit: Blue Canyon Technologies

The problem: The effects of climate change are everywhere — in stronger storms, drier droughts and more acidic oceans. To avoid the worst impacts of climate change, we must limit the world’s temperature rise as quickly as possible, which means dramatically cutting greenhouse gas emissions from fossil fuels and other sources.

What we’re doing about it: We’re working with partners around the world, and across the public and private sectors, to use the power of markets and technology to drive down pollution quickly and affordably — and to shift the world to clean energy as fast as possible. We’re also exploring how power sources like hydrogen can affect climate change.