Missing Methane: The decarbonization risks and opportunities of financed methane emissions

Missing Methane: The decarbonization risks and opportunities of financed methane emissions

Financed emissions reporting by the six biggest US banks doesn’t show if they’re improving. Focusing on methane can yield results.

Introduction

In 2019 and 2020, the six largest US banks – Bank of America, Citi, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo – set targets to decarbonize their oil and gas portfolios. So far, however, the Big Six have yet to demonstrate clear reductions in their financed emissions.

Much of the ambiguity in the banks’ progress on climate has been due to instability in the various metrics used to measure financed emissions, which are calculated based on ever-shifting factors such as emissions reporting methodology, portfolio composition, and even energy prices. These issues are discussed more fully in our previous report, Carbon Conundrum: The Curious Case of Financed Emissions.

While financial carbon accounting metrics are likely to become more accurate as methods and standards evolve, we don’t have the luxury of time: investors and other stakeholders need ways to assess banks’ climate risk management today.

Focusing on methane is part of the answer.

Oil and gas methane emissions are significantly underreported and pose a material climate transition risk to banks’ oil and gas company financing.

How methane shows up in banks’ financed emissions

Methane generally appears in banks’ financed oil and gas emissions in their clients’ operational emissions. To calculate these emissions, banks gather data from client company reports and data broker estimates and aggregate them into a single financed emissions metric. However, these emissions data sources often underestimate methane emissions due to the standard practice of using emissions factors derived from engineering estimates – as opposed to directly measuring emissions on the ground.

Methane abatement should be central to banks’ plans to meet their 2030 financed emissions targets. Although these targets cover all three scopes of banks’ oil and gas clients – and the largest share of emissions consists of Scope 3 – banks’ strategies for achieving their 2030 goals rely disproportionately on driving down their clients’ Scope 1 emissions, much of which is methane.

Tracking the Big Six

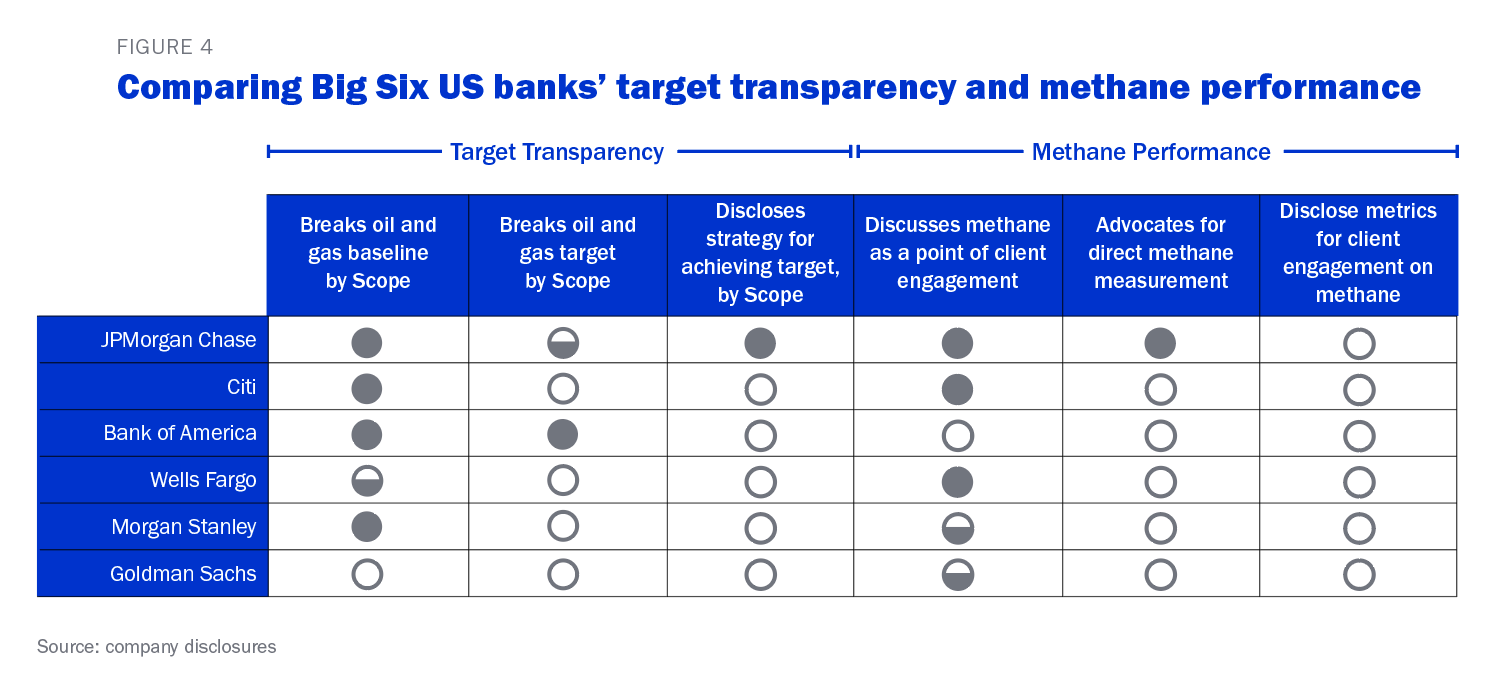

With six years left to achieve their 2030 financed emissions targets, no major US bank is currently providing sufficient disclosure on the strategies to achieve targets and address portfolio methane risk.

JPMorgan Chase leads in the steps it has taken to call out methane through its 2023 Methane Emissions Opportunity report, which details the specific actions JPMorgan Chase is taking to engage oil and gas clients and improve direct methane measurement. To a lesser extent, Citi has also discussed oil and gas methane emissions as a component of the sector’s transition strategy and its own client engagements. Other banks lag these two in their treatment of methane.

Comparing Big Six US banks on methane

Recommendations for banks

Banks are well positioned to push for strong methane emissions management as part of climate planning within their oil and gas portfolios. We recommend the following best practices for banks to address methane opportunities and risks:

Client Engagement

- Encourage clients to join OGMP 2.0. Achieving OGMP’s ‘Gold Standard’ for methane measurement is the core indicator of determining whether companies are credibly pursuing improvements in methane emissions management.

- Incorporate methane performance in company evaluations. Banks should consider integrating methane performance as part of screening clients, conducting due diligence, and setting terms of finance.

- Provide financing bespoke to the challenge of measuring and mitigating methane emissions. Banks should work with industry to find ways of addressing this need, with finance made available contingent upon best-in-class targets, measurement, and reporting.

Enhanced Reporting

- Disclose more granular engagement metrics on methane. Engagement metrics are critical to demonstrate clear and consistent year-over-year progress toward addressing climate transition risks while the carbon accounting for existing financed emissions metrics improves.

- Disclose how methane emissions factor into 2030 targets. To build stakeholder confidence and demonstrate credibility, banks should disclose their strategic plans for how to achieve 2030 financed emissions targets.

- Publish a dedicated methane risk and opportunity report. A comprehensive report should detail the bank’s current efforts and future plans to mitigate methane risks from their oil and gas portfolios.

Public Support

- Publicly support OGMP 2.0 and strong methane policies. Beyond OGMP 2.0, banks should consider publicly supporting upcoming methane regulations, such as state-level implementation plans of the US EPA’s oil and gas methane rule, along with emerging regulations and initiatives in Canada, Mexico, the European Union, Japan, and elsewhere.