Carbon Credits 101 For Investors

Carbon Credits 101 For Investors

For investors in companies that purchase carbon credits, understanding credit integrity is important to gauging climate performance.

Carbon credits represent both an opportunity and a risk for companies and their investors. High-integrity carbon credits can help accelerate the net zero transition by financing emission reduction and removal activities that are critical to stabilizing the global climate, supporting local livelihoods, and safeguarding biodiversity.

To help the financial community assess the opportunities and challenges, EDF developed a primer on key topics related to carbon credits and carbon markets, and recommendations on how investors can evaluate portfolio businesses for their alignment with best practices.

Recommendations

- Carbon credit use should complement, not replace, direct decarbonization. Companies can use carbon credits to contribute to global climate action through Beyond Value Chain Mitigation—measures to prevent, reduce, or remove emissions outside a company’s value chain—and augment their science-aligned decarbonization targets. This embodies a “Yes, and” approach to corporate climate action.

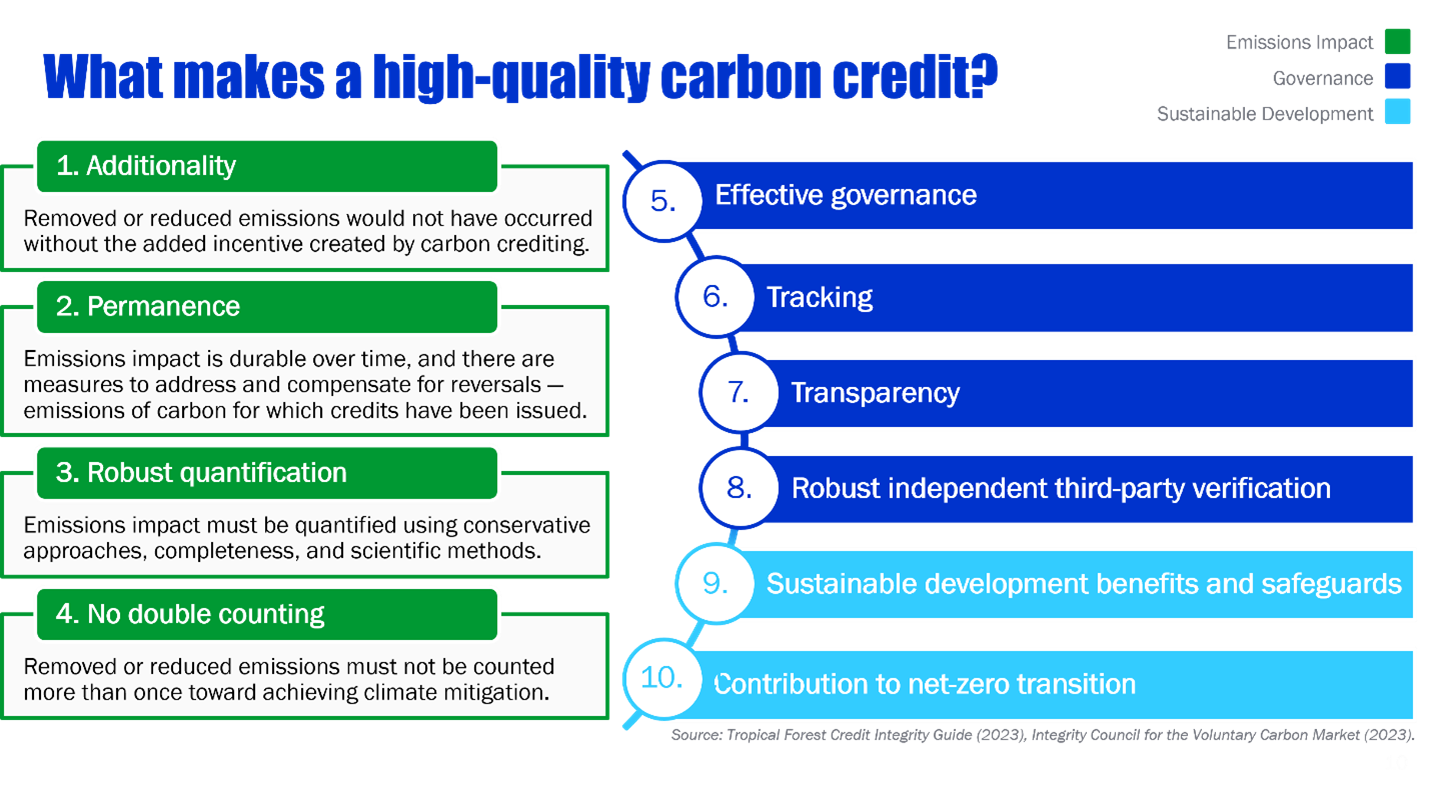

- Carbon credits should be high integrity. Buyers should conduct due diligence to ensure credits have environmental and social integrity and align their purchasing behavior with net-zero needs and guidance as they evolve. Useful resources for due diligence include the Carbon Credit Quality Initiative, the Carbon Offset Guide, and the Tropical Forest Credit Integrity Guide.

- Claims linked to crediting should be specific and accurate. Companies should articulate the role credits play in their climate plan. The VCMI Claims Code of Practice has guidance for how companies can make clear and informative claims about their carbon credit usage.

- Disclosures should be transparent and comprehensive. Companies should publicly disclose the quantity of carbon credits they purchase and retire. At the carbon credit level, disclosures should include the project and/or program, Project ID and serial number, host country, issuing year, and any co-benefit certifications.

- Advocate for strong carbon credit policies and standards. Carbon credit buyers are an important voice in increasing the integrity of the voluntary carbon market. Companies should participate in integrity initiatives and advocate for strong standards.