No region of the US is unaffected by the impacts of climate change. From recent flooding in California to impending sea level rise along the East coast, the increased risk of climate disasters has made every community more vulnerable.

New research published in Nature Climate Change led by EDF economists finds that increasing flood risk due to climate change pose threats to the stability of the US housing market. Published with researchers from First Street Foundation, Resources for the Future, the Federal Reserve, and several academic institutions, our research revealed that the real estate located in flood zones is overvalued by US$121–US$237 billion due to unpriced climate risk.

Growing flood risk—and a growing bubble in the housing market

Currently, over 14.6 million properties in the United States face at least a 1% annual probability of flooding, with expected annual damages to residential properties exceeding US$32 billion. The increasing frequency and severity of flooding under climate change is predicted to increase the number of properties exposed to flooding by 11% and average annual losses by at least 26% by 2050.

The increasing risk and cost of flooding due to climate change has led to growing concerns that housing markets are mispricing these risks, thus causing a real estate bubble to develop.

Supported by a grant from the National Science Foundation’s Megalopolitan Coastal Transformation Hub, the study is the first-ever national-scale assessment of climate risk to property values, using the property-specific, climate-adjusted First Street Foundation flood model. To do this, we evaluated the extent to which property values already account for the costs of flooding. We then compared those price discounts with property prices that fully capture expected damages from flooding over the next 30 years.

We found a nearly $200 billion dollar bubble.

The cascading and inequitable impacts of unpriced flood risk

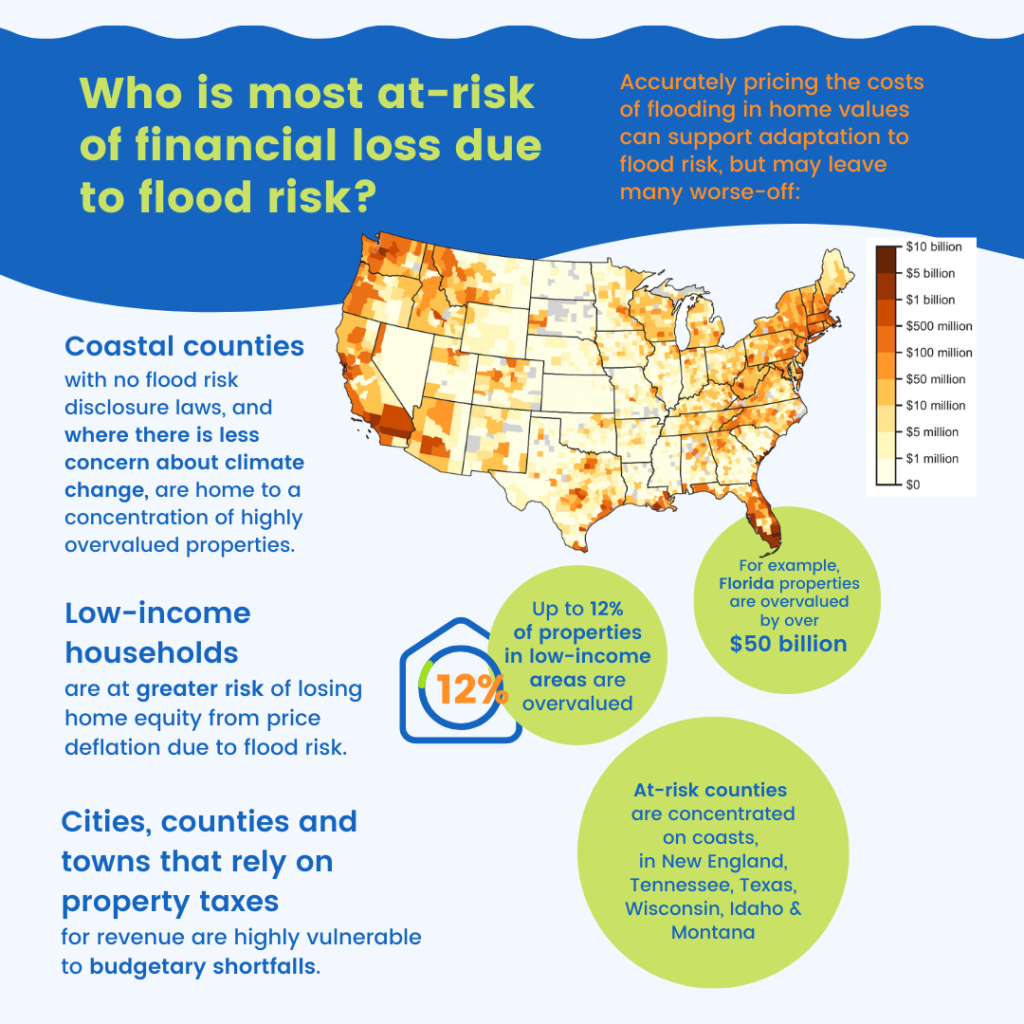

Accurately pricing the costs of flood in home values is needed to support climate adaptation and to remove perverse incentives for development in floodplains. However, doing so could have negative financial impacts on households, communities, and municipalities. In the event that property values fully account for exposure to climate risk, our results raise concern that:

- Low-income communities are particularly vulnerable. The extent to which flood risk is not priced into housing values varies based on neighborhood and state characteristics, with low-income households at a higher risk of losing home equity . Such inequities have the potential to exacerbate wealth gaps in the US.

- Coastal housing markets are particularly vulnerable. In general, we find that highly overvalued properties are concentrated in counties along the coast with no flood risk disclosure laws and where there is less concern about climate change. In particular, properties in Florida are overvalued by more than US$50 billion.

- Municipalities that are heavily reliant on property taxes for revenue could experience budgetary shortfalls if housing prices are corrected for flood risk. Cities and towns concentrated in coastal counties, as well as inland areas in northern New England, eastern Tennessee, central Texas, Wisconsin, Idaho and Montana, are particularly vulnerable to losing revenues in the event of a pricing correction. In these areas, local governments may need to adapt their fiscal structure in order to continue to provide essential public goods and services.

We need efficient and effective climate change policies

The cost of unrealized flood risk in the US real estate market is an increasing threat to economic stability for households, communities and municipalities. Despite clear need for improving flood risk communication via updated flood maps, broadening flood risk disclosure laws at the state and federal level, and increasing investment in flood risk reduction, the realization of these risks will largely depend on policy choices that influence the distribution of flood-related costs in society. In effect, these policy choices will require decision-makers to grapple with moral questions about who should bear the costs of climate-related disasters.