Stock gifts: Two easy options for giving

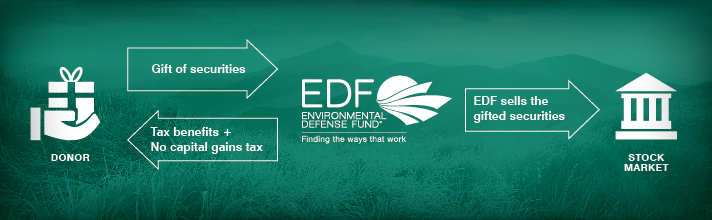

Donating stocks, bonds or mutual funds to EDF is a smart investment and will deliver strong results for the environment. Making a gift of appreciated securities is surprisingly simple and may provide you with significant tax benefits.

Option 1: One-step donation through DonateStock

EDF has partnered with DonateStock.com to enable supporters to make stock donations in minutes. By using this widget, you can donate stock through a secure portal, making the gifting process fast, safe and free.

After filling out a simple form, they'll work with EDF and your broker to transfer and liquidate your shares, deposit the proceeds with EDF, and ensure you're promptly receipted for your gift.

Keep in mind: Your shares must be publicly-traded, held for at least one year, and appreciated in value to use this option. If your shares do not meet these criteria, or if you intend to donate your stock to EDF's sister organization, EDF Action, please use Option 2 below instead.

PLEASE NOTE: IF YOU’VE DONATED SHARES THROUGH OPTION 1 VIA DONATESTOCK, YOU’RE DONE. DON’T PROCEED TO OPTION 2.

Option 2: Three-step alternative method

In some cases, you may need or wish to coordinate your stock donation yourself. This includes gifts of depreciated stock, privately-held or thinly-traded stocks, and stocks you've held less than a year. This method is also required when donating shares to EDF's sister organization, EDF Action.

Step 1

In order for us to provide a proper receipt for your tax benefit, complete our online form before you transfer your shares to EDF’s account at The Hollenbaugh, Rukeyser, Safro, and Williams Team UBS Financial Services, Inc.

Step 2

Send your broker the following stock transfer information. Please ask them to provide your name with the stock transfer.

| Environmental Defense Fund | EDF Action | |

|---|---|---|

| Tax deductible? | Yes. As a 501(c)(3) organization, contributions to EDF are eligible for charitable deductions within the limits prescribed by US law. | No. As a 501(c)(4) organization, contributions to EDF Action [Environmental Defense Action Fund] are not tax-deductible. |

| Tax ID | 11-6107128 | 90-0080500 |

| Account number | Y1 88010 | Y1 88029 |

| DTC number | 0221 | 0221 |

| Receiving Institution | The Hollenbaugh, Rukeyser, Safro, and Williams Team UBS Financial Services Inc. |

The Hollenbaugh, Rukeyser, Safro, and Williams Team UBS Financial Services Inc. |

Questions? We're here to help Monday-Friday, 9am-5pm Eastern time.

Aimee Gibbons

Director, Member Services

Environmental Defense Fund

Phone: (202) 572-3325

Email: stockgifts@edf.org

Step 3

EDF will sell the stock and send a donor tax receipt using the contact information you provide.

If you prefer to make your stock gift anonymously, we are happy to honor your request. A name and valid contact information must still be supplied so that we may receipt your stock gift.

Fill out the form below to get started!

Please note that as a 501(c)(3) tax-exempt charitable organization, Environmental Defense Fund cannot accept gifts made to promote or oppose particular political candidates. Those interested in political gifts might consider the work of our advocacy partner, Environmental Defense Action Fund.

EDF commits to responsible and respectful use of your information. Please see our privacy statement and privacy statement terms & conditions for full details.